Manual process errors top list of data reconciliation pain points for financial firms during pandemic

Nearly a third (28%) of financial services organisations say mistakes from manual processes are their biggest data reconciliation pain point amid the work-from-home drive, research shows

16 March 2021, London UK — Nearly a third (28%) of financial services organisations say that mistakes from manual processes are their biggest data reconciliation pain points. This is according to research released today from data firm Duco and Financial Technologies Forum (FTF), exploring the experiences of reconciliation teams within the global financial services industry.

Error-riddled processes, which are harder to manage while people work from home, cause more headaches to reconciliation teams than a lack of operational data (19%), operational risk (15%), internal politics (11%), compliance (6%) and regulatory risk (3%).

These manual processes lead to poor quality data, poor decisions and are costing financial firms millions in wasted man hours and regulatory fines, according to the study by Duco.

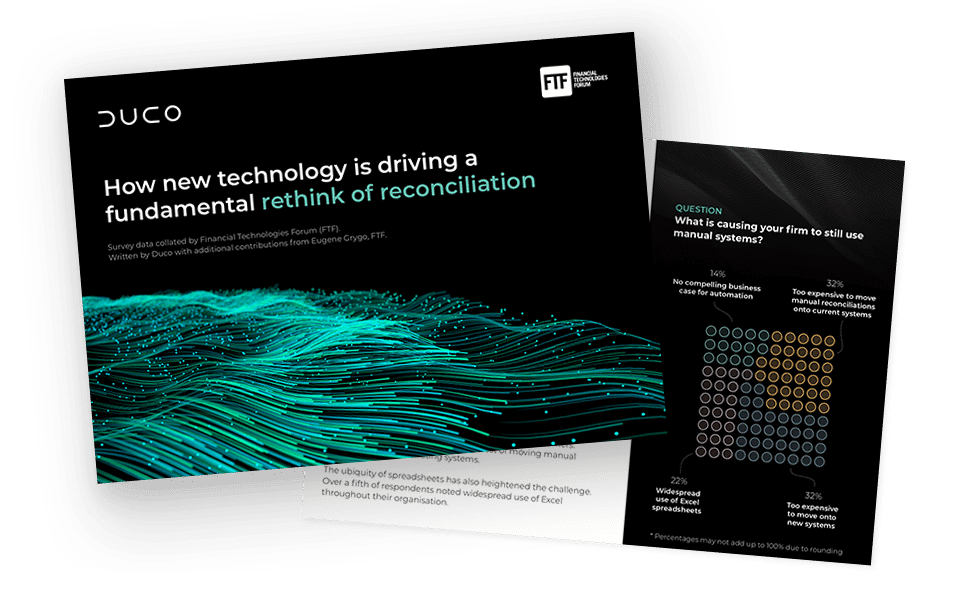

The report also finds that around three fifths (64%) of financial services firms believe that implementing transformational change to these processes would be too expensive or time consuming within their organisation. As a result, just over one in five (22%) are able to automate most of their reconciliations.

However, the future of data reconciliation looks bright. Two thirds (66%) of financial services organisations expect new solutions that automate manual processes to be one of their top-three greatest investment areas in the next three years — while 68% expect to have fully automated their reconciliation function within the next five years.

Christian Nentwich, CEO, Duco said: “We understand why firms rely heavily on manual processes for their reconciliation. They’re easier to implement compared to old tech-heavy solutions, and everybody gets how Microsoft Excel works.

“But manual processes are costing firms substantial money and keeping resiliency risk high. One of Duco’s clients had a spreadsheet with an incorrect calculation that was costing them close to $3 million every year in addition to the continuing operational fixed cost of manual processes and reputational risk. But now there is a huge opportunity with new technology to help financial services organisations save considerable man hours, mitigate operational risk and comply with regulation.”

Click here to download the full report or check out our reconciliation solution in more detail.